How to Boost Your Credit Score Before Buying a Home

A higher credit score can save you thousands on your mortgage. Learn smart, simple ways to improve your score before applying for a home loan.

If you’re planning to buy a home soon, your credit score is one of the biggest keys to unlocking better interest rates, smoother approvals, and lower monthly payments. The higher your score, the stronger your buying power.

But here’s the good news: Even if your score isn’t perfect right now, you can take smart steps to improve it before applying for a mortgage.

✅ First: Know Your Score

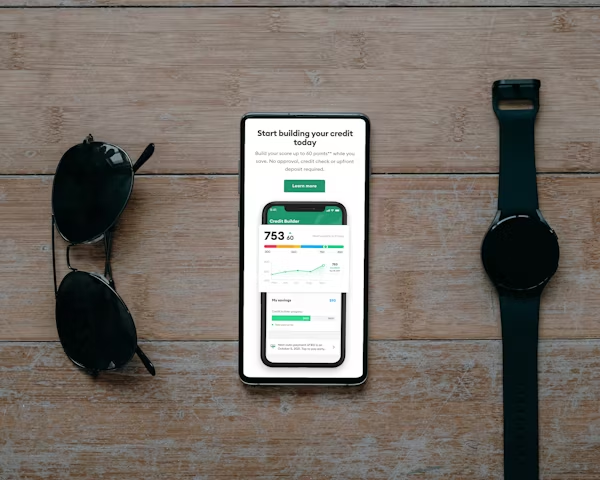

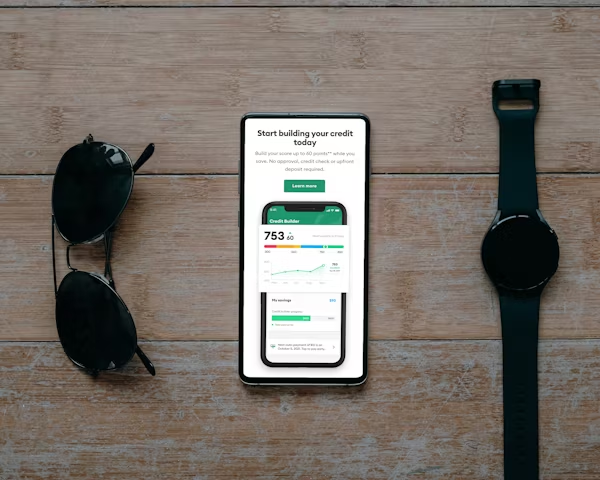

Before you can improve anything, you have to know where you stand. You can check your score for free once a year at AnnualCreditReport.com, or use apps like Credit Karma or your bank’s credit monitoring tool.

Most lenders use FICO scores ranging from 300 to 850. Here’s the typical breakdown:

-

800+ = Excellent

-

740–799 = Very Good

-

670–739 = Good

-

580–669 = Fair

-

Below 580 = Poor

To qualify for most home loans, you’ll generally need at least a 620. but a 740+ score will give you the best rates.

💳 1. Pay Your Bills on Time

This is the #1 factor in your credit score. Even one late payment can ding your score significantly, especially if it’s recent.

Pro Tip:

Set up auto-pay or reminders so you never miss a due date. Staying current helps build trust with lenders.

📉 2. Lower Your Credit Utilization

This means keeping your balances low compared to your total available credit. Ideally, you should use less than 30% of your credit limits.

Example: If you have a $5,000 limit, keep your balance under $1,500.

Bonus Tip:

If you can pay off balances in full, that’s even better!

🏦 3. Don’t Open New Credit Cards

Every time you apply for new credit, a “hard inquiry” hits your score. Opening multiple accounts in a short time can make lenders nervous.

If you’re planning to buy a home soon, hold off on new accounts until after you’ve closed.

🧾 4. Keep Old Accounts Open

Length of credit history matters! If you have older accounts in good standing, keep them open, even if you don’t use them often.

Closing them could shorten your credit history and hurt your score.

🔍 5. Dispute Inaccuracies

Errors happen more often than people think. Check your reports for things like:

-

Duplicate accounts

-

Incorrect late payments

-

Outdated personal info

You can dispute errors directly with the credit bureaus. Fixing one mistake could give your score a boost.

🧠 6. Avoid Major Purchases

Even if your score is solid, taking on new debt, like buying a car or financing furniture, can change your debt-to-income ratio and delay your loan approval.

Wait until after you’ve closed on your home to buy that giant sectional or upgrade your ride.

💬 Final Tip:

Improving your credit score doesn’t have to take forever. Many buyers can see improvement in just 30–60 days with the right steps.

I work with lenders who specialize in helping buyers improve their credit before they apply. If you’re not sure where to start, I’ve got trusted pros who can help you build a custom plan.

📞 You can reach out to me at 865-712-1993 or Trish@TrishManciniHomes.com. You can also check out my website at TrishManciniHomes.com (more resources can also be found at my resource hub HomeSweetClosed.com).

Categories

Recent Posts